Developing Property in 2021? 5 Key considerations to prepare for in the current market

As we move forward into the back half of 2021 the market remains strong in pockets but getting projects off the ground remains challenging.

- Development finance

- Planning delays

- Lack of qualifying Pre-Sales

- Price stagnation

- Construction Cost Increases

Development Finance

Reset your Project Feasibility and try to be more pessimistic

Its hard for developers to be pessimists but sometimes you should be. If you haven’t had a valuation carried out for funding purposes you should be cautious on your projected revenues. If your current project feasibility assumes low-interest rates, bullish sales off the plan and optimistic timelines do yourself a favour and stress test your assumptions. Run some more conservative numbers to see the effect this has on your bottom line profit.

Smarter developers are allowing higher finance costs and factoring of common delays to reach you project milestones (e.g increased presales timeframes and push back of construction start dates).

Remember its always good to under promise and over deliver!

Planning Delays

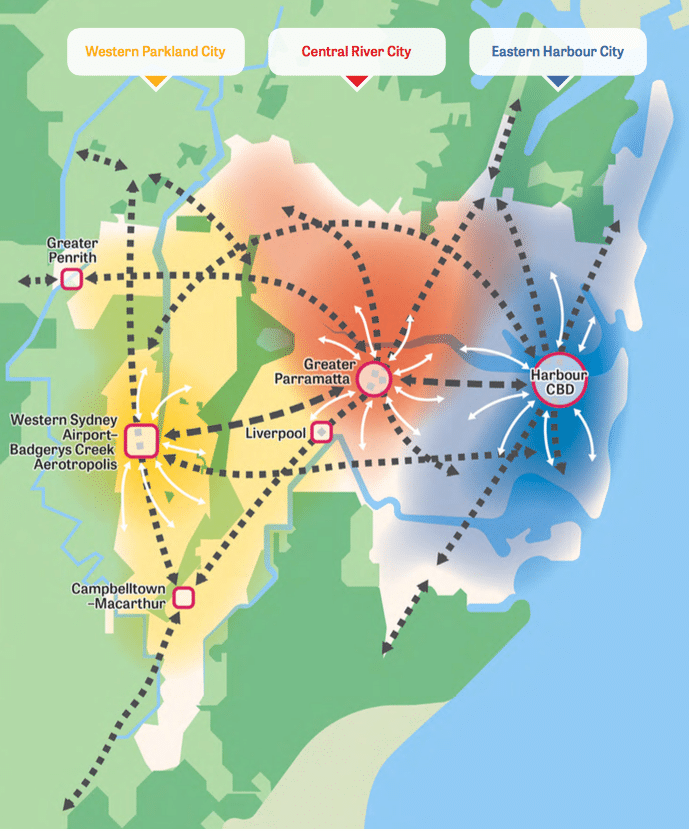

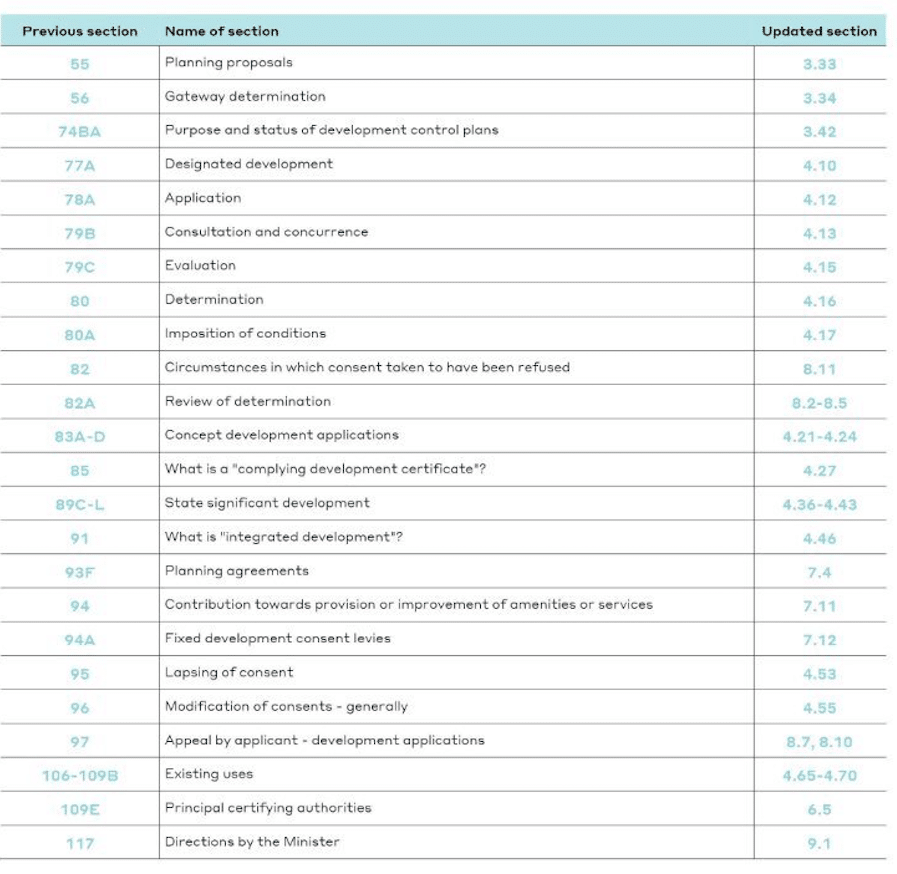

Steer clear of sites with rezoning and infrastructure risk

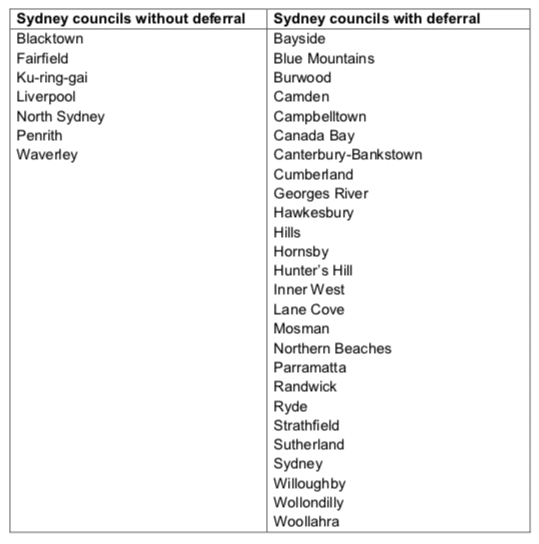

If you are a small to mid-sized developer right now you should avoid developing sites that require rezonings or significant developer (or government) contributions towards key infrastructure.

Governments are constantly in flux and key service providers (e.g Sydney Water, RMS) are inefficient and disinterested in your infrastructure problems. Many government announcements are made for political reasons but not all projects are funded and virtually none get delivered on time.

Focusing on areas that don’t rely on rezonings or major infrastructure will provide you with tangible outcomes.

Lack of Qualifying Presales

Where have all the off the plan buyers gone?

With a lot of completed developer stock on the market buyers now have a choice between buying new (generally owner occupiers) or buying off the plan (generally investors hoping for price growth before settlement).

With the foreign investor market flat theres generally not as many off the plan buyers around at the moment. Smaller boutique projects in established locations will be well positioned to break ground in these challenging times as lenders agree to fund construction without debt cover via exchanged contracts. Try and secure your construction funding with a zero presales condition even if you plan to sell off the plan, it gives you more pricing control and potential uplift once the projects completed.

Presales are a numbers game, smaller projects will get funded with zero presales and allow you to sell during construction.

Non-bank lenders will work with you to ensure your project revenues are not capped and will allow flexibility if market conditions keep changing.

You should see your lender as a project partner at all stages of the development journey.

Pricing Stagnation

Know your market and be cautious of predicting bullish price increases

Momentum continues to shift in Sydney as house and townhouse prices are booming but only pockets of apartment prices are rising. Recent sales indicate prices are flattening out and falling in pockets of oversupply. Developers should be cautious in the pricing of unsold stock and look to residual stock loans so they don’t flood the market with product upon completion.

Allow in your feaso for contingencies such as incentives, increased sell down periods and completed stock holding costs. If you rate of sale has slowed or stopped altogether your price point needs review.

Construction Costs

The only way is up

In Sydney year on year tender inflation is +4.5% this equates to a +25% increase in building costs over the last 5 years. This is a big risk to your projects quality and feasibility. Be wary of builders who are providing you with seemingly cheap pricing – do your research on their track record and financial stability prior to signing a contract.

If you are unsure about the construction costs in your market engage a QS early on to provide you with high-level current cost information so you can have a better idea of pricing expectations prior to design finalisation and tender stage.

OUR PROCESSESS

CPC Development Lending Solutions secures market leading finance on your behalf – we get projects funded.

Working closely with our developer clients we are that new set of eyes that stress test your feasibility and project assumptions around revenue and costs.

We examine presales targets, project delivery team, transaction structure, funding request and timings. This allows your project to be presented professionally and takes it to the front of the queue leveraging off our strong non bank lending relationships.

Engaging CPC allows you to focus on managing your project and driving your consultant team.

For more information about CPC Development Lending Solutions check out our FAQ page