Should I fix my new rate? How you can capitalise by refinancing in the current rate environment

Written by David Lovato – CPC Lending Solutions

October 2024

As interest rates have risen sharply over the last two years, the share of non-performing commercial real estate (CRE) loans at banks has increased, according to the Reserve Bank of Australia (RBA).

While this uptick may cause some concern, it’s worth noting that these levels remain low by historical standards. In fact, according to the RBA, “There continues to be little evidence of financial stress among owners of Australian CRE.”

Even in this challenging interest rate environment, now is a prime time to consider refinancing your loans in anticipation of potential interest rate cuts next year.

Interest rates forecast

According to the big four banks, the Australian Securities Exchange (ASX) and many other economists, the RBA is likely to start cutting rates early next year.

The global economic landscape is already trending downwards. Last month, the US Federal Reserve made its first interest rate cut. This followed several other big economies including the UK, Canada, China and Europe which have also begun their rate-cutting cycles.

And, because Australia typically follows a similar trend to these developed economies, it indicates we are likely nearing the end of the current cycle.

With rates set to ease and economists predicting cuts early next year, now is an ideal time to explore refinancing options. Waiting until the end of the year could leave you scrambling as the market slows during the holiday season, making it more difficult to explore loan options or secure approvals.

Fixed rates or not?

As you review your refinancing options, you’ll need to decide between a fixed-rate mortgage or a variable rate. Currently, some fixed rates are lower than variable rates, which may seem tempting. However, fixing your rate now could prevent you from benefiting when rates are cut further in 2025, as widely expected.

But, fixing rates now could lock you out of potential savings in the near future. If you fix your rate now and the RBA cuts rates multiple times in 2025 – as is expected – you could miss out on the lower payments that variable rates will offer next year.

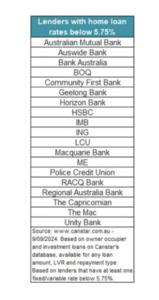

Some borrowers have already seen potential savings with fixed rates, as some banks have begun lowering their rates (see table summarising lenders offering rates below 5.75%).

However, borrowers should keep in mind the longer-term benefits of not fixing rates.

For developers and investors, there’s a bigger picture. By choosing not to fix now, you’ll maintain the flexibility to adjust your strategy as rates continue to shift downwards, maximising your project’s profitability.

Private credit options

In the real estate sector, the private credit market is growing significantly. Private lenders who have matured over the last several years are actively looking for new sites and projects to finance. According to the RBA, as of July, around 11% of business lending and one-quarter of lending to small businesses was provided by non-bank lenders.

With traditional banks tightening their lending criteria, private lenders may fill that gap as an alternative source of funds for CRE.

Private lenders offer the flexibility and speed to capitalise on opportunities in a softening interest rate environment. Whether you are looking to refinance an existing project, purchase a new site or secure residual stock loans to buy time until rates fall, there are attractive options.

Now is the time to act

Whether you’re a borrower or an investor, now is the moment to explore your refinancing options. If you have an existing loan, refinancing could help you lock in lower interest rates and reduce your monthly repayments.

For developers, the current rate environment also presents an opportunity to invest in new projects. Market conditions are favourable for acquiring sites and starting developments, with the growing private credit market offering flexible and attractive funding options

Additionally, savvy developers can take advantage of residual stock loans, which offer temporary financial relief while planning their next move. These loans help bridge the gap until rates drop further, giving you more time to strategise.

CPC Lending Solutions is a property development and residential finance specialist. Whether you’re a developer needing funding for land, construction, or residual stock, or a buyer looking for the perfect mortgage, we’re here to help. Contact us at [email protected] or fill in this form.