What are the odds of a bank collapse happening here in Australia?

Written by David Lovato – CPC Development Lending Solutions

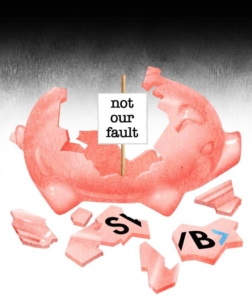

You’ve probably seen the news on the collapse of Silicon Valley Bank – the second-largest in American history.

So what happened?

* SVB had to sell securities at a loss to get cash

* To counter this loss, SVB announced it would sell US$2.5 billion of shares

* Investors advised companies to withdraw their funds, which prompted a bank run

* Within 48 hours, the federal government had to step in because the bank could no longer pay its clients

In the wake of the SVB collapse, and the consequent downgrading of the entire US banking sector from stable to negative by Moody’s, Australians may be wondering how safe our banks are.

Australian banks are strictly regulated and must comply with prudential standards. The regulatory body, APRA (the Australian Prudential Regulation Authority), is an independent statutory authority that answers to the federal parliament.

Although APRA does everything it can to prevent a financial institution from failing, it can’t guarantee that will never happen.

If an APRA-regulated institution fails, the government can activate the Financial Claims Scheme, also known as the ‘government guarantee’, under which the government guarantees deposits of up to $250,000 per account holder.

___

Crowd Property Capital is a property development finance specialist. We help you structure and submit your finance applications to lenders across Australia. Contact us at info@crowdpropertycapital.com.au