Australia’s apartment supply forecast to plunge sharply

Written by David Lovato – CPC Development Lending Solutions

Australia is suffering a housing shortage, with the national vacancy rate just 1.0%, according to SQM Research. To counter this shortage, and to cope with an increasing population and immigration, additional housing is needed. But not enough apartments are being built.

Property advisory group Charter Keck Kramer estimates that 41,200 apartments will be constructed across the capital cities in 2023. But their estimates for the next two years are much lower:

- 27,300 in 2024

- 11,100 in 2025

That would be a 73% national reduction in two years. Their forecast decreases in construction for the major cities are:

- 87.8% in Brisbane

- 83.5% in Sydney

- 78.3% in Canberra

- 65.3% in Melbourne

- 65.2% in Perth

The reasons Charter Keck Kramer are forecasting fewer apartments will be built include:

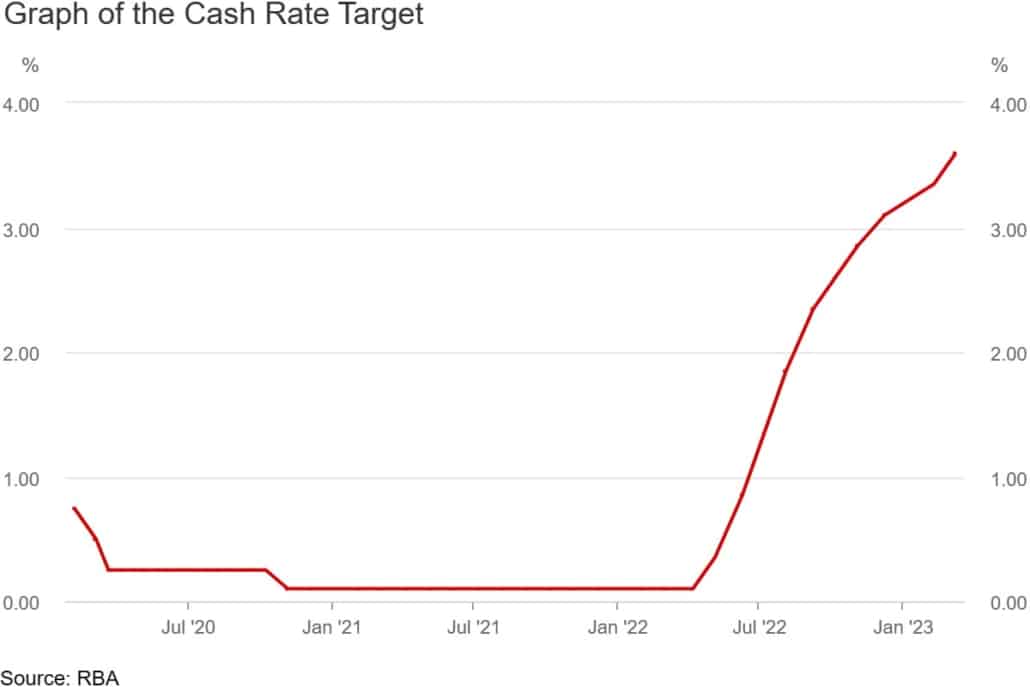

1. Rising interest rates

The Reserve Bank has increased the cash rate for 10 months in a row. In March 2023, it was 3.60%, which is the highest rate since May 2012.

The Reserve Bank may increase the cash rate further, due to high inflation.

The Australian Bureau of Statistics (ABS) reported that annual inflation was at:

- 7.8% for the quarterly measurement ending in December 2022

- 7.4% for monthly measurement up to January 2023 (this is based on a limited set of prices)

The Reserve Bank wants to reduce inflation to be between 2-3%. Although they see the slight decrease of 0.4 percentage points from December 2022 to January 2023 as positive, they are concerned the inflation rate will stabilise at a high level. To prevent this, the Reserve Bank may increase the cash rate again.

Rising interest rates affect developers in two ways:

- Developers experience an increase in their borrowing costs

- Buyers experience a reduction in their borrowing capacity, so may not be able to afford to buy these apartments

2. Rising construction costs

Residential construction has become more expensive because of:

- A labour shortage – when Australia shut its border during Covid-19, it disrupted the flow of migrant workers, which still hasn’t been fixed

- A shortage of materials – global supply chains were disrupted by Covid-19

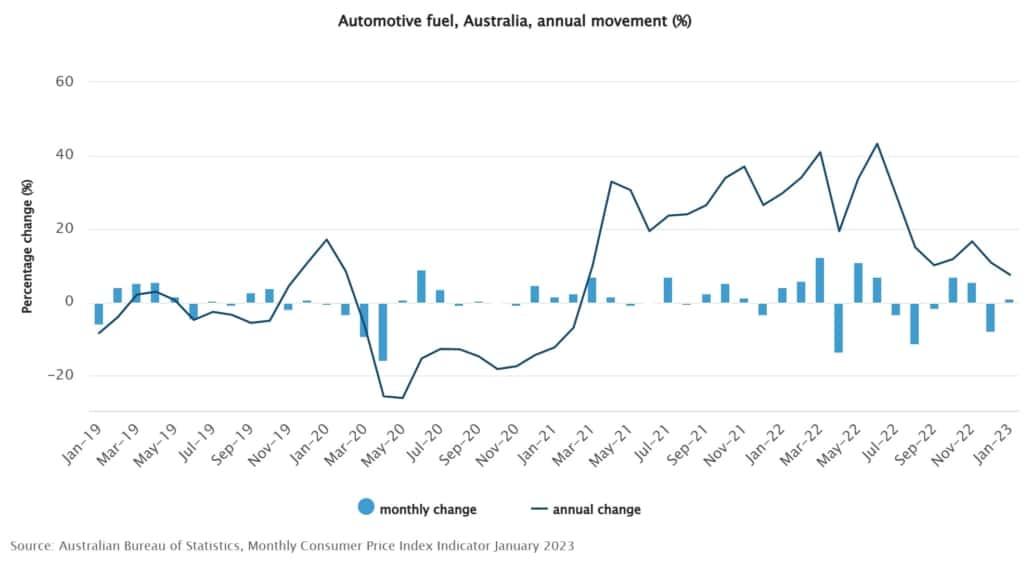

- Increased transport costs – transport costs rose 6.3% for the year to January 2023, while automotive fuel prices rose 7.5% (see graph), according to the ABS

3. Reduced profits

The combination of rising interest rates and construction costs has resulted in some developments no longer being financially feasible, according to Charter Keck Kramer director of research and strategy Richard Temlett.

“Rising rates are increasing project costs and also diminishing purchaser capacity and buyer demand, which is leading to slower presales in many projects,” he said.

“Alarmingly, but not surprisingly, construction costs continue to increase and the residual supply constraints have resulted in many projects not being financially feasible. This will lead to certain projects being deferred or even abandoned.”

Temlett also said prices would have to rise. “Otherwise, developers won’t build it because of the heightened risk they are taking.”

So with increasing demand and fewer apartments being constructed, the supply of apartments may plunge.

Crowd Property Capital is a property development finance specialist. We help property developers overcome their funding challenges by sourcing loans for land, construction and residual stock. Contact us at [email protected] or fill in this form.