Selling your Development Site? 5 Things you should consider…..

September 2017

Written by David Lovato

More and more developers these days are asking themselves should I sell one (or more) of my sites and consolidate operations? Why would a developer sell their lively hood? Are they in trouble? Are they too stretched? What’s happening to their business?

There are many reasons why a developer may consider selling a site (raw or approved) but they have usually decided to curb expansion plans or had unforeseen delays on existing sites or need to free up capital to complete other projects. If the developer goes about it the wrong way it can greatly tarnish their brand and market perception.

Here are 5 things to consider before listing your development site with an agent:

1. Is there any demand for my site?

If your site is located in an area of future oversupply be prepared to not find a buyer. Banks and private lenders are ruling out funding certain suburbs of Sydney. Limited ability for an incoming developer to obtain finance means your pool of buyers is extremely limited.

2. What’s my pricing strategy? Can I still make money on the site?

If you have purchased a site within the last few years and got a DA approval then you know exactly how much the site owes you. Site values peaked in 2015 so many sites bought at the peak may not re sell for the same value. You should trying put aside your emotions, agents will always pump up the sale price but talk to valuers and development managers. They know how much a site is worth, you should be ready to accept a fair price. Don’t get greedy or your strategy may backfire.

3. Do I really want to advertise this sale with a major agency?

Signing an agency agreement with one of the big agents is like pulling your pants down. You are exposing your business to speculation that things are not going as planned and you will pay for the privilege. You will be assured of a vast database of buyers (none qualified) and you will run an expensive print and media campaign. A scattergun approach that exposes your business in this delicate situation is not the answer. A targeted and swift off market campaign is a better strategy to keep you divestment plans private, find qualified buyers and free up your capital ASAP.

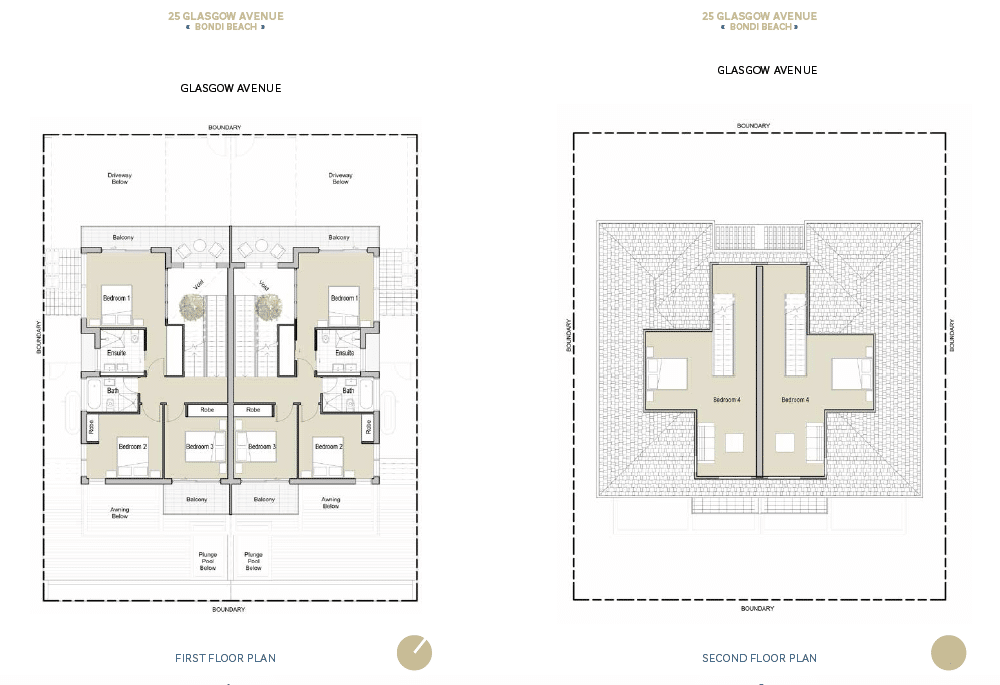

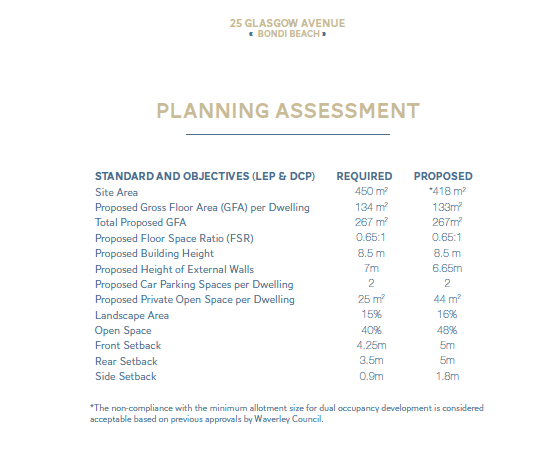

4. My site is DA approved, it must be worth more?

In todays market more often than not developers are looking for raw sites, the market has peaked and smart developers are looking at sites for the next cycle. Expert developers will have their own brand and strategy and your DA adds no value to the transaction. The time and effort spent on getting the approval has no doubt been considerable but putting emotions aside and seeing it through the buyers eyes will help manage expectations.

5. Understand your buyers financial position

Once your site is for sale you will receive a wide range of offers. Some will be high and others extremely low and opportunistic. You should take a vested interest in reviewing the companies behind all of your offers, you must understand your bidders. It is likely a high bid is from an operator who is willing to pay more to ride out the cycle, the risk is their financial capacity to settle. Most land banking developers will not need finance and they will not pay over the odds – they are probably your underbidders.

Written by David Lovato from Crowd Property Capital, CPC is a peer 2 peer platform providing capital funding channels for Australian property development. For more information visit www.crowdpropertycapital.com.au