Building backlog with 40,000 homes in limbo as high costs and interest rates bite

Written by David Lovato – CPC Development Lending Solutions

June 2024

The construction of nearly 40,000 homes across Australia has stalled, despite the projects all having the necessary building approvals in place, according to a recent KPMG report.

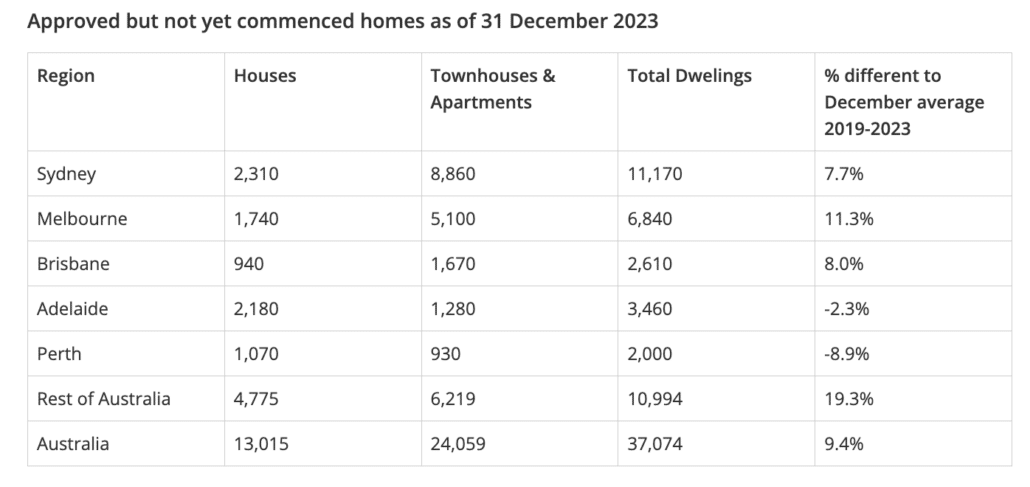

KPMG’s analysis found that, as of 31 December 2023, over 37,000 dwellings had been approved in Australia but construction had not commenced. This figure represents a 9% increase compared to the previous five-year average.

This increase is alarming, particularly as Australia grapples with a deepening housing supply crisis, characterised by rising prices and rent.

To make matters worse, the backlog is most acute in high-density dwellings such as townhouses and apartments, which are crucial for delivering housing at scale.

KPMG urban economist Terry Rawnsley said that, in Sydney and Melbourne alone, these types of dwellings constitute approximately 80% of the nearly 18,000 halted projects.

“There is always a lag between housing being approved and construction commencing, but current estimates show an abnormal number of dwellings sitting in this category, suggesting other market factors are stalling the pipeline of new builds,” he said.

Rawnsley noted that Sydney has been particularly hard hit with more than 11,000 projects approved but not yet commenced in the most recent quarter.

“With the pool of newly approved dwellings falling, one might expect the pool of not yet commenced dwellings to be falling too, but it remained steady,” he said.

Meanwhile, Melbourne had 6,840 dwellings pending as of December, one of its highest figures over the past five years.

Brisbane and the ACT also reported significant numbers of stalled projects, with:

- Brisbane seeing an 8% increase over its previous five-year trend

- The ACT nearly doubling the number of approved but unbuilt dwellings from 864 to 1,772.

Why the stall?

Several factors are contributing to the delay in projects breaking ground.

Foremost among them are skyrocketing construction costs, even though building materials price growth has levelled off since the pandemic highs.

However, labour and borrowing costs are through the roof with higher interest rates and robust wage demands from trades inflating costs significantly.

Simultaneously, rising interest rates have squeezed potential buyers’ purchasing power, further complicating the market dynamics.

As a result, many projects designed pre-COVID are now financially unfeasible as the cost increases have outpaced potential revenues. This problem is particularly pronounced in areas like western Sydney, a major hub for new housing developments, where new apartment prices are more constrained.

This economic squeeze is prompting developers to either shelve projects indefinitely, creating what Rawnsley terms “zombie approvals,” or to shift focus towards more profitable luxury developments, reducing the number of units in favour of higher returns.

Crowd Property Capital is a property development finance specialist. We help property developers overcome their funding challenges by sourcing loans for land, construction and residual stock. Contact us at info@crowdpropertycapital.com.au or fill in this form.