Does a construction loan include land?

Written by David Lovato – CPC Lending Solutions

February 2025

When planning to build a new home, a common question asked by borrowers is “Does a construction loan include land?”. Understanding this and how a construction loan works can impact your financial strategy.

A construction loan is a type of short-term financing designed to cover the cost of building a new dwelling or substantially renovating an existing one. Unlike a conventional mortgage, which provides a lump sum upfront for the purchase of an existing property, a construction loan is paid out in stages as your building project progresses. This is also known as ‘drawing down’ your funds.

One of the key differences between a construction loan and a regular mortgage is that you will only pay interest on the amount drawn down in your construction loan. This can help keep your monthly repayments lower.

It is a common assumption in property development financing that construction loans automatically include the cost of the land, too.

Does a construction loan cover land?

Whether or not a construction loan covers land depends on the lender.

Some lenders allow borrowers to bundle the purchase of land with the construction of the dwelling into one home loan. This single loan covers both land acquisition and construction. The loan will be disbursed in stages, with the first release of funds used to purchase the land. Thereafter, the loan functions as a construction loan, paying out in stages as your build progresses.

But, other lenders do not offer a bundled loan, instead allowing separate financing. This might require you to take out a land loan first and then apply for a construction loan once the building plans have been finalised.

From a lender’s perspective, these two options cover a range of scenarios, including developers or borrowers who already own the land and now just require financing to build the dwelling.

Additionally, for landowners who have low or no debt on their land, some lenders may offer an equity release option. This allows the landowner to access the equity in their land as part of the construction loan, providing additional funds for the project or even for securing their next development.

In certain scenarios, the lender may provide a cash-out component at the start of construction, allowing developers to secure their next project while the current one is being built. This will depend on maintaining the overall construction maximum loan-to-value ratio (LVR), but it can be particularly helpful for developers managing overlapping projects.

However, this process varies from lender to lender, so it’s recommended you work with an experienced finance broker who can help you find a loan that suits your current financial situation and long-term goals.

At CPC, we understand that every project is unique. Our approach to property development financing is to work closely with borrowers to understand their specific circumstances and tailor a financing solution that meets their individual needs. We consider the project as a whole, including the land acquisition if necessary, to find a financing solution that works for you.

Key factors that determine construction loan structure

Lenders will assess several criteria when deciding whether a construction loan can include the land purchase. These may include:

- LVR: This represents the percentage of the total project cost (including land) covered by the loan amount. A lower LVR means you will need a larger deposit.

- Borrower’s deposit: If you want to include the purchase of the land in your construction loan, you may need a larger deposit.

- Construction timeline: Some lenders require construction to commence within a set period after the land purchase. This ensures that the land is used as intended and that the project progresses as stated in the plans.

- Land zoning and permits: Lenders often require approved building plans and necessary permits before approving land financing to reduce the risk of project delays or complications.

Construction loan versus land loan: What’s the difference?

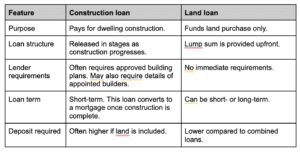

If a bundled loan is not an option for you, or there are other reasons you want to separate the two, it is helpful to know what the differences are between a construction and land loan.

Land loan: This is typically used to purchase vacant land without immediate plans for construction. This type of loan often has shorter terms and higher interest rates than construction loans

Construction loan: This will finance the building of the dwelling and is drawn down in stages. Borrowers will likely be required to provide approved plans to the lender.

How CPC helps borrowers finance land and construction

At CPC Lending Solutions, we understand that every borrower’s situation is different. Whether you need a construction loan for land and building, a separate land loan, or alternative financing options, we can help find a solution that aligns with your property development goals.

Our expertise is in property development financing, which allows us to find flexible and tailored loans for your project’s needs. Working with a specialised lender like CPC Lending Solutions means you have access to more knowledge of the industry as well as personalised service.

If you’re exploring how to finance land and construction, our team at CPC can guide you through the process. Contact CPC Lending Solutions today to discuss your construction and land financing needs.