Developers shelve projects as construction costs soar

Written by David Lovato – CPC Development Lending Solutions

June 2023

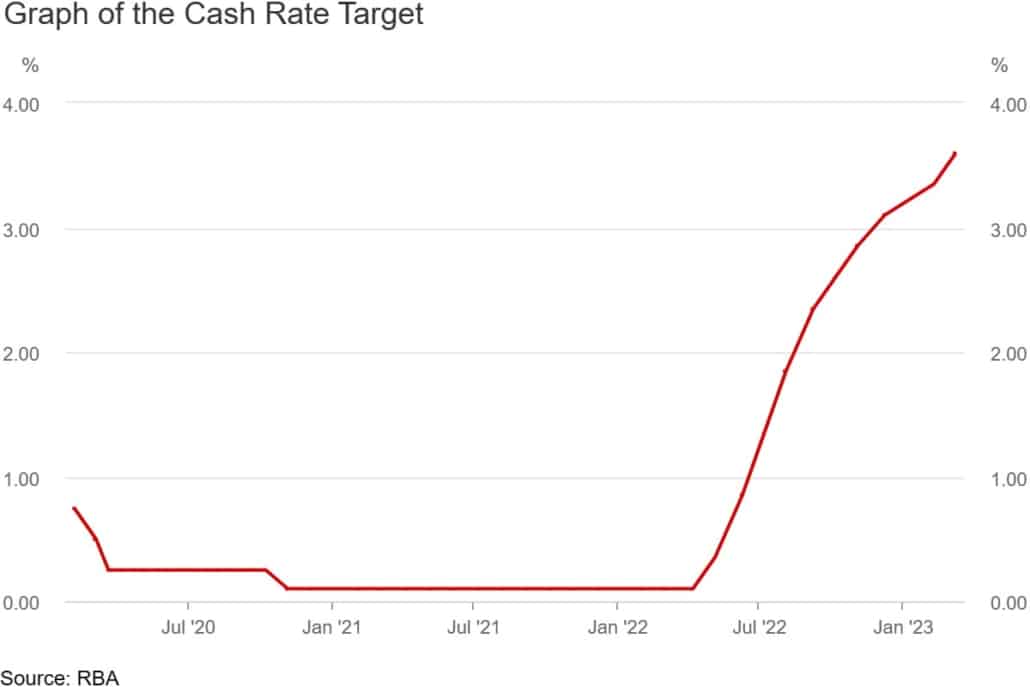

Another month, another 25 basis point rate hike from the Reserve Bank of Australia – with the latest move taking the official interest rate to an 11-year high of 4.10%.

It’s not just homeowners who are feeling the pain from higher interest rates; property developers and homebuilders are too, leading to a massive slowdown in construction levels.

For instance, Australian Bureau of Statistics data showed building approvals hit an 11-year low in April, after total dwelling approvals fell 8.1% over the month, following a 1.0% drop in March.

Multi-unit approvals fell to just 3,469 – 35.4% fewer than the same time last year.

The slowing rate of construction comes at a time when many capital cities are already grappling with a housing supply crunch that’s driven vacancy rates close to record lows.

It gets worse.

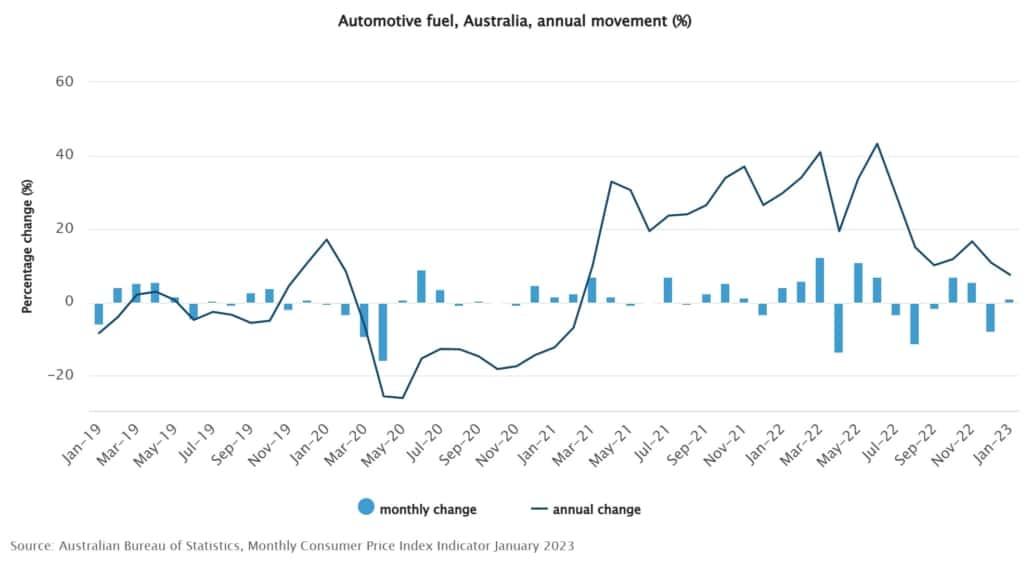

That’s because the RBA’s interest rate rises haven’t happened in isolation; rather, they’ve occurred amid a 30% surge in residential construction costs during the two years to March 2023, according to KPMG Australia.

This, in turn, has led to an increasing number of projects being put on hold, despite already gaining planning approval.

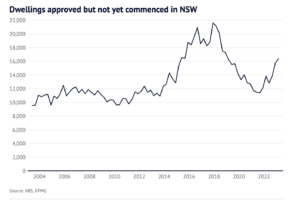

KPMG’s analysis found almost 16,400 dwellings in New South Wales were approved but not yet commenced by the end of March, up from 13,800 at the same time last year.

As the graph below shows, the last time there was such a vast backlog of paused construction projects with approvals was in 2019. However, back then, developers in Sydney were hitting the brakes due to a historically high vacancy rate of 3.5%.

By contrast, Sydney’s vacancy rate was just 1.1% in May, according to Domain.

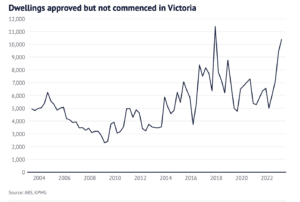

Similarly, in Victoria, almost 10,500 dwellings were approved but construction had not yet commenced by the end of March, the highest number of stalled projects since December 2017.

KPMG urban economist, Terry Rawnsley, said around three-quarters of the not-yet-commenced dwellings in New South Wales and Victoria were slated to be apartments or townhouses.

“Both Victoria and New South Wales have increased demand for new dwelling approvals, but dwellings are far from materialising, due to significantly higher input costs,” he said.

Managing cost overruns in development finance

There’s no doubt skyrocketing prices, as well as material and labour shortages, are making the development environment particularly challenging.

So you may be wondering if there’s anything you can do to avoid costs spiralling out of control on your project.

Well, in many cases, prevention is better than cure.

That means:

- Estimating costs accurately: Don’t be tempted to use a one-size-fits-all approach. Rather, do your due diligence in the planning phase to create a realistic budget.

- Planning for surprises: Identify and assess risks that could lead to cost overruns, and develop a risk management plan with contingency funds.

- Clearly defining project scope: Changes in project scope are a common cause of cost overruns. So use a robust change order control process that includes assessing the impact of proposed changes on cost, schedule, and quality before approving them.

- Tracking your budget: Monitor your project progress and costs regularly. This includes comparing actual costs against the budget, tracking project milestones, and promptly addressing any deviations.

- Contingency planning: Allocating contingency funds in the project budget to account for unforeseen expenses. The contingency amount should be based on a realistic assessment of potential risks and should be managed carefully throughout the project.

Crowd Property Capital is a property development finance specialist. We help property developers overcome their funding challenges by sourcing loans for land, construction and residual stock. Contact us at info@crowdpropertycapital.com.au or fill in this form.